- Published on

From Global Rearmament to Kraken Robotics: Tracing the Geopolitical Links

- Authors

- Name

- NenyaCat

- @nenyacat

Introduction: Why Kraken Now?

In 2024, global military expenditure reached an all-time high of $2.718 trillion.

According to SIPRI (Stockholm International Peace Research Institute) data released in April 2025, this represents a 9.4% increase year-over-year—the steepest annual rise since the end of the Cold War. It also marks the tenth consecutive year of growth.

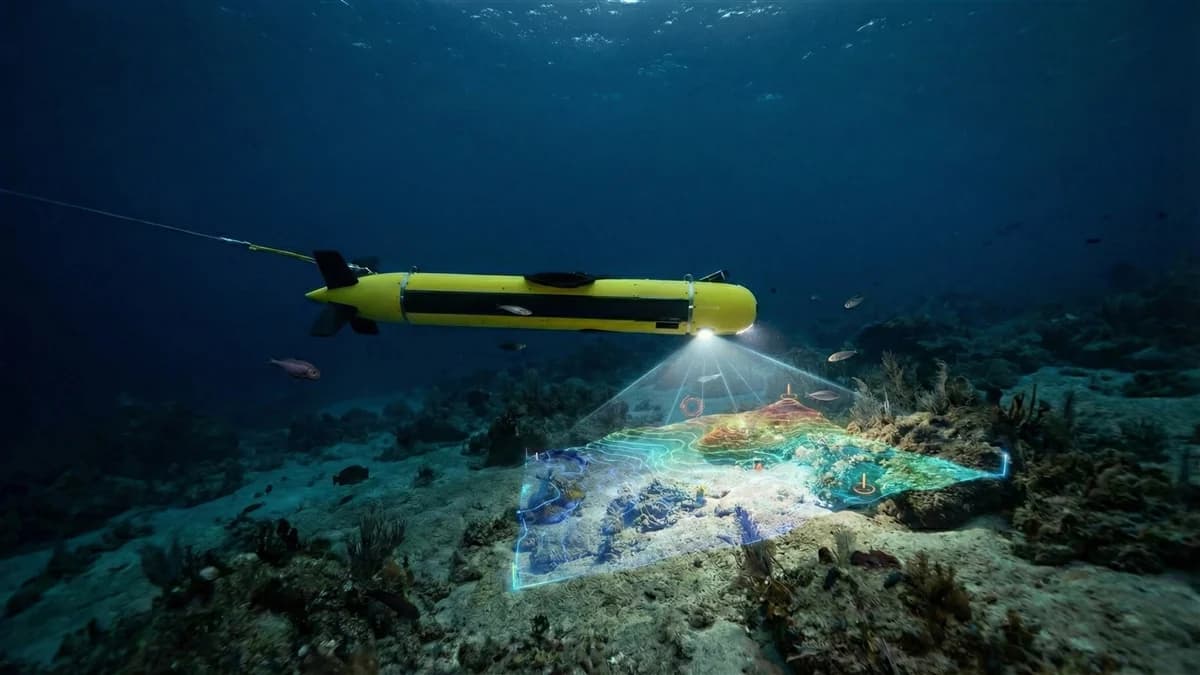

Re-ignited geopolitical tensions following the war in Ukraine, the US-China standoff in the South China Sea and Taiwan Strait, sabotage of undersea cables in the Baltic Sea, and the race for resources in the Arctic—all these disparate events are converging into one massive trend: "Maritime Autonomy."

The world is rearming, and the oceans are at the center of it. Deep beneath the surface, a small Canadian company, unknown to most investors, is supplying the mission-critical components for this new era.

For a detailed analysis of Kraken's technology, please refer to the Technical Moat Analysis. This article focuses on "Why Kraken Now" from a top-down macro perspective.

Macro Background: Why is the World Arming?

Global Rearmament by the Numbers

🌍 Global Defense Spending Trend (2020-2026E)

Global defense spending hits record highs, expanding Kraken's TAM

+9.4%

2024 YoY Growth

$2.718T

2024 Record High

7.4%

CAGR (2020-2024)

This chart represents more than just increased spending; it signifies a structural shift.

| Indicator | 2020 | 2024 | Change |

|---|---|---|---|

| Global Spending | $2.24T | $2.718T | +21.3% |

| USA | $778B | $886B | +13.9% |

| China | $252B | $335B | +32.9% |

| NATO Europe | $1.1T | $1.48T | +34.5% |

| CAGR (2020-2024) | - | - | 7.4% |

Of particular note is the rapid increase in NATO Europe. Since the Russia-Ukraine war likely began in 2022, starting with Germany's €100B special defense fund, the entire continent is exceeding the "2% of GDP" defense spending target. As of 2024, 23 out of 32 member nations have met this goal, and by 2025, it is projected that all members will achieve it for the first time in history (PBS, Defense News).

US FY2026 Budget: The Year of Autonomous Systems

Analyzing the US Navy's FY2026 budget request, $5.3 billion has been allocated solely for unmanned systems, a significant increase of $2.2 billion compared to FY2025 (DefenseScoop). Specifically, approximately $734 million is designated for Unmanned Underwater Vehicles (UUVs). Department of Defense-wide, $13.4 billion is allocated for autonomy-related programs.

US Navy Unmanned Systems Budget (FY2026, Total $5.3B)

├── UUV (Unmanned Underwater Vehicles): $734M

├── USV (Unmanned Surface Vehicles): $890M

├── Integrated Undersea Unmanned Systems: $1.2B

├── Lionfish/Viperfish UUV: New Procurement

└── R&D and Other: $2.5B+

Kraken's SeaPower batteries and AquaPix sonar are Bottleneck Technologies that inevitably see demand across all these categories.

Geopolitical Links: A Map to Read

Three Global Hotspots

🔗 Geopolitical Connection Diagram

Click on nodes to view detailed information

South China Sea: The frontline of the US-China maritime hegemony competition. In these waters, through which $5.3 trillion in annual trade passes, both nations are engaging in "Gray Zone Tactics" to maintain a standoff without direct conflict. The US is accelerating the deployment of unmanned undersea surveillance networks to counter China's artificial island bases.

Baltic Sea: In November 2024, the BCS East-West Interlink between Lithuania and Sweden and the C-Lion1 cable between Finland and Germany were severed simultaneously. On Christmas 2024, the Estlink 2 power cable between Finland and Estonia was also cut. In response, NATO launched the "Baltic Sentry" mission in January 2025, deploying naval drones and frigates to intensify undersea infrastructure monitoring. Considering that 95% of global internet traffic travels through undersea cables, the importance of this market is evident.

The Arctic: Climate change is opening the Northern Sea Route (NSR) and intensifying the competition for resource development. In this region, where Russia, China, Canada, and the US are vying for influence, Kraken, being Canada-based, holds a distinct geographical advantage.

AUKUS: The Game Changer

The AUKUS (Australia-UK-US) alliance is not just about military cooperation; its core is "Technology Sharing."

- Australia: Acquiring 8 nuclear-powered submarines + Ghost Shark XLUUV program.

- UK: Submarine technology transfer led by BAE Systems.

- US: Anduril selected as the Ghost Shark integrator.

In September 2025, the Australian government signed a 5-year contract worth AUD $1.7B (approx. USD $1.1B) with Anduril Australia (Australian Dept of Defence). This contract covers the delivery, maintenance, and continuous development of Ghost Shark XL-AUVs. Here, Kraken serves as a key subsystem supplier to Anduril, providing SeaPower large-format battery modules for the Ghost Shark. The first prototypes were delivered ahead of schedule in 2024, with the first production vehicles slated for delivery to the Royal Australian Navy in January 2026.

Structural Shift in Military Strategy: Why "Unmanned"?

The Equation of Cost and Life

A traditional conventional submarine costs approximately $3.4B. Adding 20 years of operational costs brings the total to over $5B. In contrast, Anduril's Dive-LD XLUUV is estimated to cost under $30M per unit.

| Comparison | Conventional Sub | XLUUV |

|---|---|---|

| Unit Cost | $3.4B+ | $30M |

| Crew | 100+ | 0 |

| Mission | Months | Weeks ~ Months |

| Risk | Loss of Life | Loss of Equipment |

| Scalability | Low | High (Mass Prod) |

"Minimizing loss of life" is a politically sensitive issue in democratic nations. Weary of "Body Bag Politics" post-Iraq and Afghanistan, Western nations have pivoted towards "Expendable Unmanned Platforms."

UUV Market Outlook

🤖 Global UUV Market Projection (2023-2032)

Kraken's growing market share amidst rapid UUV market expansion

$8.14B

2032 Market Size

13.5%

Est. CAGR

70%

Military Share

8%+

Kraken Target Share

The UUV market is projected to grow to between $5.6B and $11B by 2030. While estimates vary by agency, the direction is consistent: military applications account for over 70%, with a CAGR of 7-15%.

Kraken's current market share is around 2-3%, but its exclusive supply relationship with Anduril is the variable that could drastically change this figure.

Kraken's Strategic Position: The "Picks and Shovels"

Lessons from the Gold Rush

In the 19th-century California Gold Rush, the ones who made the most consistent money weren't the miners, but Levi Strauss and Samuel Brannan, who sold jeans and pickaxes.

Kraken adopts the same strategy:

We do not build the entire platform. We build the core components that must be used, regardless of who wins.

Kraken Partnership Ecosystem

Key Customers and Supply Relationships

Technical Moat

Kraken's core technologies—SeaPower™ pressure-tolerant batteries, AquaPix® Synthetic Aperture Sonar, and 3D at Depth LiDAR—form a "bottleneck" that must be resolved for underwater autonomous systems to function. For a detailed analysis of these technologies, refer to the Technical Moat Analysis.

Three Scenarios: My View of the Future

Rather than a single forecast, I believe it is realistic to posit three scenarios.

Three Scenario Analysis

Three possible futures for Kraken that I see

Positive Scenario

Sustained Defense-Led Buildup

Key Assumptions

- •Global mil. spending maintains 7.4% CAGR

- •NATO pressure for 2% GDP target intensifies

- •AUKUS Ghost Shark program on schedule

- •US autonomous systems budget execution ramps up

Kraken Impact

Revenue surge via Anduril partnership (Dive-LD, Ghost Shark supply acceleration).

Stock Implication

Significant upside potential vs current valuation

Risks

- •Concentration on defense revenue

- •Capacity expansion speed

Catalysts

- •Major Anduril contract

- •Ghost Shark production start

- •Addl. US Navy orders

Positive Scenario

Geopolitical tensions persist, and NATO/AUKUS budget execution proceeds as planned. Global military spending maintains its current growth trajectory, Anduril's Dive-LD mass production begins in earnest, and Ghost Shark deliveries to Australia start around 2027.

I view this as the most probable scenario, supported by current ongoing contracts and backlog.

Negative Scenario

International regulations on autonomous weapons tighten, ESG pressure expands, or geopolitical tensions ease unexpectedly. Discussions on UN autonomous weapons regulations could progress into actual treaties, or past dealings with Elbit Systems could be highlighted as an ethical issue.

Personally, I consider the probability of this scenario to be relatively low, as current conflicts show no signs of short-term resolution.

Neutral Scenario

Military and commercial revenues balance out, leading to gradual growth. Demand for private seabed exploration (offshore wind farms, etc.) grows, and the RaaS (Robotics as a Service) model generates stable cash flow.

While not as exciting as the positive scenario, this represents the most stable investment case in terms of risk/reward.

Risk Check: What Could Go Wrong?

One should not blindly trust optimism. Here are the scenarios where this investment thesis could fail.

The Elbit Systems Connection

Kraken signed a KATFISH towed SAS supply contract with Elbit Systems, a major Israeli defense contractor, in 2015. Delivered in 2017, it successfully completed integrated sea trials with Elbit's Seagull USV in 2018. This cooperation was intended to provide unmanned mine countermeasure capabilities.

Following the Gaza conflict, one must be aware that the connection with Elbit could become a target for ethical criticism. However, this is a historical transaction from 2015-2018; Kraken's current primary customers are Anduril, the US Navy, and NATO allies.

Valuation Concerns

Discussions on the Reddit community (r/KrakenRobotics) highlight several concerns:

- High Valuation: P/E around 100x, EV/EBITDA around 26x, suggesting high growth expectations are already priced in.

- Revenue Volatility: Due to the nature of large multi-year contracts, quarterly revenue can be volatile.

- Net Loss: While Q3 2025 revenue grew 60% YoY to CAD 31.3M, the company recorded a net loss of CAD 2.7M due to scaling and R&D costs.

However, there are also many positive counterpoints:

- Revenue skyrocketed from CAD 12M in 2023 to CAD 91M in 2024, turning profitable on an annual basis.

- Possession of a "meaningful technological moat" in the seabed security and exploration market.

- Potential as a "quiet compounder" before a NASDAQ listing.

Supply Chain and Tech Risks

As a Canadian-based company, Kraken could face pressure from both sides in a US-China trade war. There are concerns about Canada's "autonomy" weakening due to increased dependence on the US (Anduril), and risks regarding the supply of Chinese raw materials (rare earths, etc.).

Furthermore, there is no guarantee that Kraken's technical moat is permanent. Major players like Teledyne, Kongsberg, and Lockheed Martin are accelerating the development of similar technologies.

The Destination of the Macro Flow

This analysis goes beyond the simple logic of "Military Spending Up → Kraken Up" to trace the causal links in the chain.

The Core of This Investment: Kraken is not betting on the success of a specific platform. It is a "Common Denominator" strategy that allows it to enjoy the growth of the entire market.

Of course, geopolitics is unpredictable. The US and China could shake hands tomorrow, or ESG regulations could strangle defense investment. That is why the three scenarios must be considered.

Summary and Checklist

Based on this analysis, here are the key points to check for your investment decision.

Positive Signals

- Global military spending maintains its current growth trend.

- AUKUS/NATO budget execution proceeds as planned.

- Mass production of Anduril Dive-LD and Ghost Shark commences.

- Kraken's quarterly revenue continues to grow.

Warning Signals

- Substantial progress in UN autonomous weapons regulation discussions.

- ESG funds moving to exclude defense stocks.

- Unexpected improvement in relationships between major powers.

- Delays in diversifying customers beyond Anduril.

Monitoring Points

- Quarterly: Kraken IR presentations, backlog changes.

- Semi-annually: SIPRI military spending reports, NATO budget execution rates.

- Annually: AUKUS progress status, Ghost Shark schedule.

Ultimately, Kraken's strategy is selling "components that are needed regardless of who wins." It is a bet on the megatrend of maritime unmanned systems, not the success or failure of a specific platform. However, the downside risk in a geopolitical détente scenario must always be kept in mind.

References

Global Military Spending & Geopolitics

- SIPRI April 2025 Release - 2024 Global Military Spending hits $2.718T

- PBS, Defense News - NATO anticipates all members to hit 2% GDP target in 2025

- NATO Official Statement - Baltic Sentry mission launch (Jan 2025)

AUKUS & Ghost Shark

- Australian Dept of Defence Official Statement - Anduril Ghost Shark Contract AUD $1.7B

- DefenseScoop - US Navy FY2026 Unmanned Systems Budget $5.3B

Kraken Robotics

- Kraken Robotics Official IR - Quarterly Results & Backlog

- r/KrakenRobotics - Investor Community Discussions

Market Outlook

- MarketsandMarkets - UUV Market Projections

- Mordor Intelligence - Military UUV Market Analysis

This article is for informational purposes only and does not constitute investment advice. Investment decisions should be made carefully based on your own judgment.